I became a Certified Bookkeeper in 2011. I had studied for 18 months and passed 5 exams in the process but didn’t have any clients until I attended a networking event, stood up for my 40 seconds elevator pitch, held an old crumpled Tesco carrier bag in the air and asked…does your Bookkeeping look like this? An energetic self – employed business coach jumped up and said…yes that’s exactly what mine looks like!

I became a Certified Bookkeeper in 2011. I had studied for 18 months and passed 5 exams in the process but didn’t have any clients until I attended a networking event, stood up for my 40 seconds elevator pitch, held an old crumpled Tesco carrier bag in the air and asked…does your Bookkeeping look like this? An energetic self – employed business coach jumped up and said…yes that’s exactly what mine looks like!

My first client was born that day and within a few weeks I had my first carrier bag to empty. This was rammed with receipts, expenses, invoices and bills for year 2010/11. I emptied the contents over my kitchen table and my immediate thought was where exactly do I start? Invoices were simple as all I needed was to sort them into date order. Bills were much the same but the aggravation came with receipts and expenses as most were screwed up and a total mess. They had to be sorted into date order then into “pigeon holes” such as motor, travel, marketing, stationery, postage, parking, printing, rent, telephone/internet etc. All these expenses are completely allowable for a business and all have to be documented, added and entered onto the year end self – assessment form to be filed online by 31st January.

My first carrier bag took me days to make sense of. Now I am much quicker as I know exactly what to look for and what to do but it makes me think of how business people can make life so much easier for their Bookkeeper or Accountant or indeed make life easier for themselves if they want to manage their own bookkeeping. The truth is that bookkeeping gets no love. Imagine that you have to record every single financial transaction made by your business, how time consuming that would be. Such valuable time that you could use better in growing your business. So that’s why it is so unpopular and gets neglected. It can be tedious and you can easily make mistakes which might prove costly.

My first carrier bag took me days to make sense of. Now I am much quicker as I know exactly what to look for and what to do but it makes me think of how business people can make life so much easier for their Bookkeeper or Accountant or indeed make life easier for themselves if they want to manage their own bookkeeping. The truth is that bookkeeping gets no love. Imagine that you have to record every single financial transaction made by your business, how time consuming that would be. Such valuable time that you could use better in growing your business. So that’s why it is so unpopular and gets neglected. It can be tedious and you can easily make mistakes which might prove costly.

It’s a known fact that 8 out of 10 entrepreneurs who start businesses fail within the first 18 months for all sorts of reasons – poor business plan, lack of clear value, poor management, no marketing platform, but what brings down most new businesses is a lack of cash brought about by losing sight of how much money is owed and how much is being spent and that’s because too much information is being rammed into carrier bags, envelopes and shoe boxes!

So let’s take a look into how “best practise” in your bookkeeping can make the difference. First you have to decide who will manage this process. OK, if it’s you the business owner, you need to be guided as to exactly what to do, how to do it and what your end product will be. If you are going to employ a Certified Bookkeeper i.e. one who is regulated by a recognised authority and covered by Professional Indemnity insurance, then he or she needs to know exactly how your business is run, what you sell, what you buy and how you like to manage all this, including bank accounts, credit/debit cards, cash payments etc.

Most Bookkeepers today should be working with proven accounting software.

My preference is Quickbooks Online which is “cloud” based like many others. Proper accounting should be a priority from the start so it’s important to get it right. Accurate books are crucial to your company’s financial health and stability so best to start early. “Cloud” Accounting is a powerful tool and will give you “real-time” information in just a few clicks which is necessary in today’s modern and fast moving business world.

My preference is Quickbooks Online which is “cloud” based like many others. Proper accounting should be a priority from the start so it’s important to get it right. Accurate books are crucial to your company’s financial health and stability so best to start early. “Cloud” Accounting is a powerful tool and will give you “real-time” information in just a few clicks which is necessary in today’s modern and fast moving business world.

I said earlier that you have to evaluate and identify what you as a business owner are good at and the chances are that it’s not in the accounts department! OK, so employ the services of a Bookkeeper, usually this will be an investment in time and money but will pay off for you.

You also need to separate business from personal spending so you don’t blur the lines.

Use a dedicated business bank account with a debit card for expenses so everything is visible on your bank statements.

Stay organised – the more organised and consistent you are throughout the year will have a knock on effect to the stability of your business.

Keep track of or get your Bookkeeper to focus regularly on which customers are paying promptly and which are dragging their heels. If they are too slow in paying maybe you don’t want to be doing any more business with them. Don’t duck out of reviewing your customers on a regular basis.

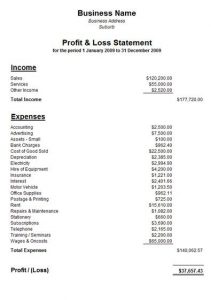

In many cases a Business owner will want to have monthly “management accounts” i.e. Profit and Loss (P&L) and Balance Sheet. Don’t forget the cash flow statement…..positive cash flow is vital in any business.

In many cases a Business owner will want to have monthly “management accounts” i.e. Profit and Loss (P&L) and Balance Sheet. Don’t forget the cash flow statement…..positive cash flow is vital in any business.

There are many other reports available but these are the main reports. The P&L will show exactly how the business has performed each month – sales income minus cost of sales and expenses will show a bottom line Operating Profit or Loss. Make sure you understand this fully and it is not just a bunch of random figures presented to you. The P&L is often the basis of where a business needs to make changes.

Consider your Bookkeeper as a kind of business “partner”. Depending on the size of your business and your needs, your Bookkeeper should never be too far away for guidance and advice. Keep him/her in the loop as your business evolves as often you can button down a better way forward with two heads together rather than battling away on your own.

The Company year end will involve additional work and if you are a Limited Company then you might also be employing an Accountant for the relevant reporting and wrapping up tax complexities etc. An Accountant has an entirely different role to play in a business than a Bookkeeper.

I hope the above will give more of an insight into a Bookkeeper’s role in your business so their appointment is important. Make sure you can both work well together and that he/she fully understands your business and how you work on it and in it. A good Bookkeeper should bring extra value to any size business and can also be a trusted business advisor with your business best interests at heart.

My company, Turnpike Business Services Ltd offers bespoke Bookkeeping services to a wide range of businesses, from self – employed sole traders to Limited Companies. My contact details are: E- mail tony.tbsbookkeeping@gmail.com Mobile 07545 758 562

To find out more about setting up your own business or to get a Free Cash Flow template, just follow this link >>>

Recent Comments